Diving Head-First: Building a C++ Trading Engine from Scratch (Project BetaTrader)

- 15 Oct, 2025

Diving Head-First: Building a C++ Trading Engine from Scratch (Project BetaTrader)

Ever stared at those stock tickers zipping across the screen and wondered, What kind of beastly software powers that chaos? Yeah, me too. I’ve always been hooked on FinTech—especially the adrenaline rush of trading. But I’m not one for just reading theory; I learn by jumping in and getting my hands dirty. So, that’s exactly what I did.

Enter Project BetaTrader: my from-scratch C++ take on an FX matching engine. Fair warning—this isn’t battle-tested for Wall Street. It’s a passion project, my way of wrapping my head around the wild world of high-performance finance.

The Big Headache: Speed Has to Be Everything

At the core of any trading system is the matching engine—the thing that pairs buyers and sellers in a blink. It needs to be blazing fast and totally impartial. The nightmare I hit early on? Locks. Slapping a mutex on every order? Instant traffic jam. Your engine grinds to a halt.

My fix: Ditch the locks on the hot path ⚡. I modeled the core/trading_core/ around a partitioned single-writer setup. Breaking it down simply:

- No more one giant, bottlenecked beast.

- Each currency pair (think EUR/USD) gets its own dedicated worker thread.

- Only that thread touches its order book. No sharing, no drama.

- Incoming commands? They slide in via a lock-free single-producer/single-consumer (SPSC) queue.

Boom—critical matching is lock-free and flies. It sticks to strict price-time priority (the golden rule of exchanges) and chews through partial fills like it’s nothing.

Okay, But What About Storing All That Data?

Lightning-fast matching is great, but what if you need to log a trade? Pausing everything to hit the database? That’s a recipe for disaster—your whole system stalls.

Here’s where I got clever: Make persistence totally async.

- The matching thread? It never even glances at the disk.

- Trade happens? It just queues up a quick “hey, save this” note.

- A separate DatabaseWorker thread grabs those notes and dumps them into SQLite in the background.

The hot path stays pristine and speedy.

Does It Actually Work? My First Stress Test

Enough yapping—let’s see the numbers. I whipped up a little log analyzer to watch the engine sweat under pressure. Spoiler: For a first swing, it crushed it.

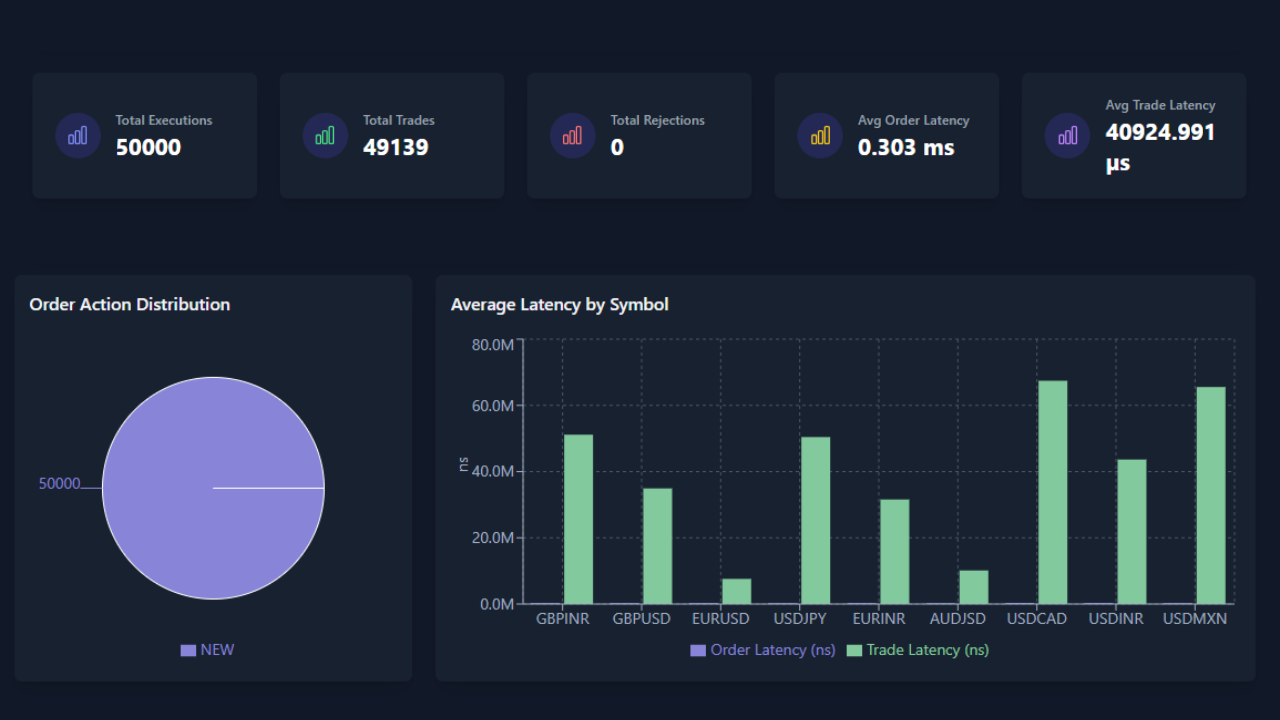

In a quick 2-second burst, it handled 50,000 new orders, spitting out 49,139 trades with zero rejects. Average latency for just acknowledging an order? A zippy 0.303 ms. And full trade latency—from submission to “done deal”? Around 41 ms (that’s 40,924 µs for the nerds).

Quick reality check: This is all on my everyday laptop, sans real-world extras like auth, networking, or data scrubbing that pile on extra lag. But as a core-engine proof-of-concept? I’m grinning ear to ear.

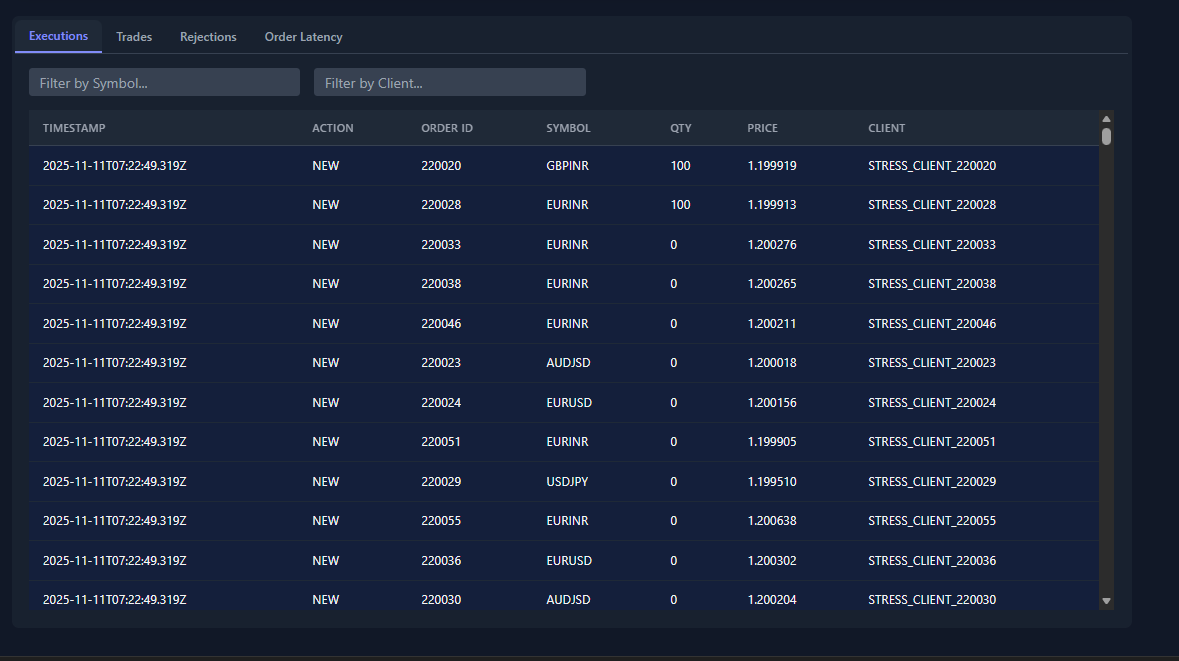

My visualizer tool was the real fun part—it let me peek at the action live:

Then there’s the latency breakdown by symbol (in nanoseconds—tiny, right?):

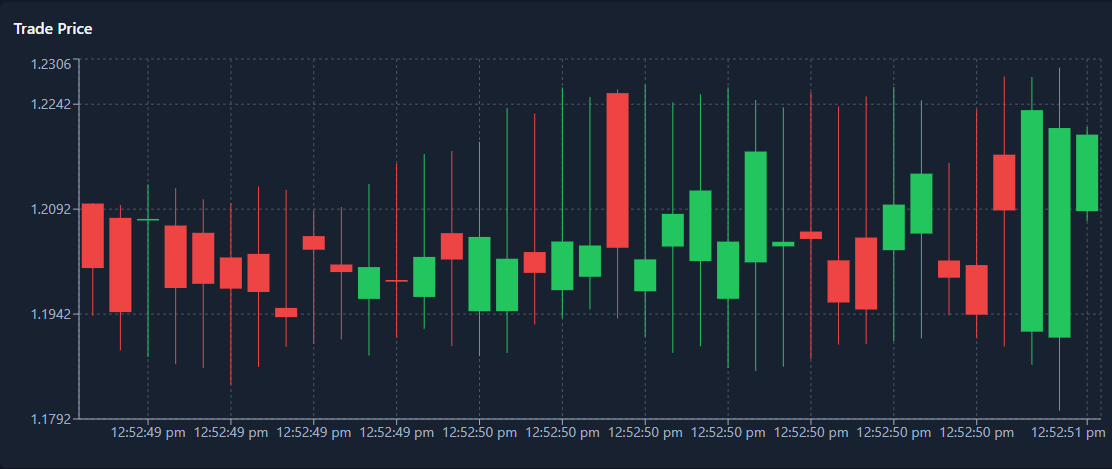

And finally, the OHLC price action chart the engine generated:

What’s Coming Up?

The matching heart is pumping strong, but right now, it’s a hermit—only chatting with my unit tests. Time to open the doors.

Next up: Tackling the gateway, the front porch where the real world knocks. In my upcoming post, I’ll geek out on implementing the FIX Protocol (yep, the trading industry’s handshake language) for message handling and session magic. The engine’s about to go live.

If you’re a tinkerer like me, a dev chasing the next challenge, or just curious about the guts of big systems—stick around! Follow for the ride.

All the code’s up on GitHub: SujalChoudhari/BetaTrader – a full in-house trading playground, complete with venue logic, gateways, and clients. Dive in!